Events

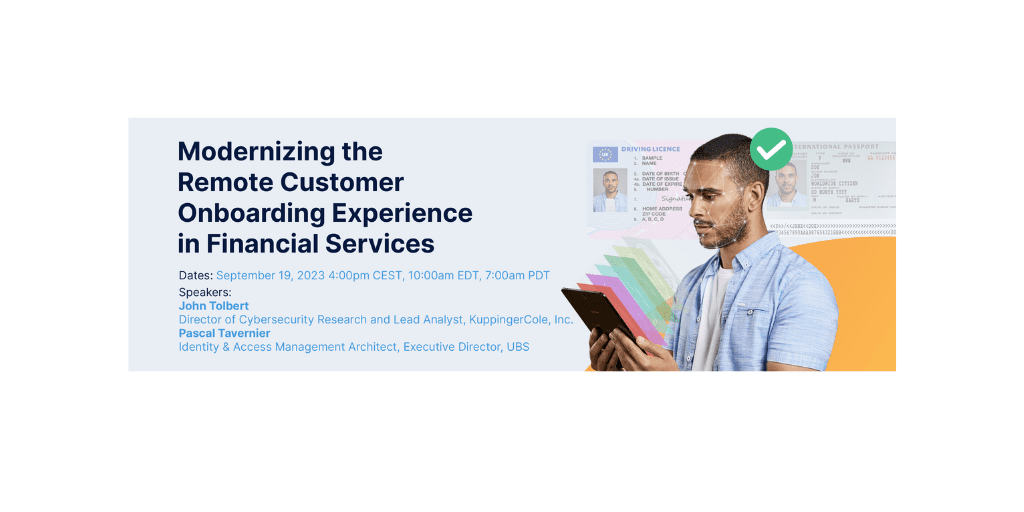

High-value, high-risk transactions that used to be in-person only, have moved online as part of the accelerated digital transformation of financial services providers in the wake of the pandemic. But delivering high levels of identity verification is challenging, leading to the adoption of new methods.

Join identity experts at KuppingerCole Analysts and a global investment bank as they discuss new ways of complying with KYC (know your customer) and AML (anti money laundering) regulations in the Finance industry, while at the same time counteracting ever-evolving fraud schemes and improving the user experience.

Listen to this webinar to:

- Find out the drivers of the demand for identity verification and proofing.

- Discover why strong identity verification is essential for digital business success.

- Get an understanding of the role of biometrics in identity assurance.

- Find out how to establish a trusted digital identity to optimize the user experience.

- Learn about the range of biometric options, their strengths, and their weaknesses.

- Understand key considerations, operational efficiencies, and cost benefits of biometrics.