August 18, 2021

In 2017, French police made a grim discovery: in an old freezer at the bottom of a woman’s garden, they found the body of her 90-year old mother who had died 10 years earlier.

The daughter was concealing the death so she could claim a pension worth $2400 a month.

This story is an extreme example of a global problem: how can insurance companies establish proof of life in a digital world? How can pension and annuity providers be certain that a person claiming from a fund is the genuine holder of the account?

iProov’s Dynamic Liveness technology is the answer. iProov provides online biometric face verification to enable insurers confirm that a remote user is the right person, a real person, and that they are authenticating right now. This helps providers of insurance products and services to:

- Protect against online fraud

- Deliver a secure yet effortless digital customer experience.

- Comply with KYC and AML regulations

- Maximize customer inclusion and accessibility

- Defend against reputational risk

Proof of life is just the start. Insurance companies can use online face verification in a number of ways. You can read our full guide to the benefits of Online Face Verification in Insurance here.

Here are two more examples:

Protecting against account takeover for pensions and annuities

Insurers can use online face verification to protect against account takeover. This is particularly important for high-value insurance products, as many people check their pension or annuity accounts infrequently.

The scenario: a policyholder has a pension that they pay into regularly through their paychecks. They rarely check or access their pension account. A fraudster gains access to the account. The fraudster could have obtained a password and username from a data breach on an unconnected site, or used social engineering.

The fraudster then poses as the policyholder and logs onto the online portal, where they change the holder’s address, phone number, and email address. After that, any security checks, such as one-time passcodes sent to a mobile device, are compromised as the genuine holder is no longer receiving the alerts. When the true policyholder tries to access the account, they find that they have been locked out. When they do get access, the funds are missing.

By impersonating the policyholder, this fraudster can access large amounts of money. Because the true account holder may only check their account once a year or less, account takeover fraud could go undetected and unreported for some time.

Preventing money laundering in insurance

Criminal networks can use insurance policies to ‘launder’ ill-begotten financial gains by depositing large sums that they then drawdown, turning dirty money into clean money. Insurance companies must protect against this.

The scenario: a criminal wanting to launder money through the international financial system buys a life insurance policy using funds from one or more bank accounts. The account is based overseas, and the amounts are small enough to avoid attracting the attention of the insurer’s fraud teams. The criminal can then cash in the policy early and request for the funds to be returned to another bank account, often in a different country.

Download our full guide to the benefits of Online Face Verification in Insurance.

How can liveness help the insurance sector?

Liveness detection enables insurance companies to authenticate the identity of an online user. It uses a biometric face scan to verify that a remote individual is the right person and a real person. This process can help to defend against cybercrime, such as account takeover or new account fraud.

Why the insurance sector needs Dynamic Liveness

Liveness enables organizations to verify that a user is the right person and a real person. Dynamic Liveness verifies that they are the right person, a real person and that they are authenticating right now. The latter is very important as it protects the insurer against digital injection attacks, which use synthetic media such as deepfakes in a way that is highly scalable and capable of causing a lot of harm.

How many people buy insurance online?

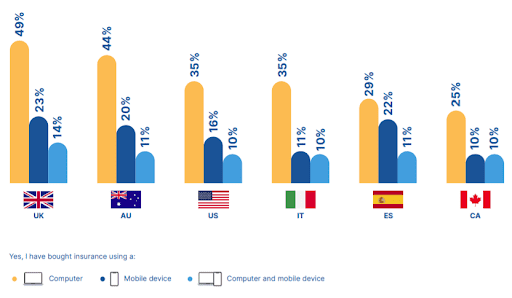

Insurers need to ensure that their customers have secure, effortless access to services online. More people than ever before are buying insurance on their computers and mobile devices, as data from a recent iProov survey shows:

- 86% of people in the United Kingdom have bought insurance online, either on a computer, mobile device, or both.

- On average, 64% of people had bought insurance online across the 6 surveyed countries.

- Purchasing insurance on a computer is more common than purchasing on a mobile device across all surveyed countries. The UK has seen the highest levels of adoption, and Canada has the least.

Insurers need to make digital services more secure, more convenient, and more inclusive for all. Defending against fraud, building customer and reputational trust, maximizing customer inclusion and accessibility, and complying with regulations—that’s the why. iProov face biometric verification technology is the how.

Defending against online insurance crime with biometrics: a summary

- The insurance sector, particularly pensions and annuities, is vulnerable to digital crime, such as account takeover fraud and money laundering.

- Customers need safe and convenient access to online insurance services. Biometric face verification and authentication from iProov enable effortless remote access for customers, while offering the highest levels of security.

- iProov’s Dynamic Liveness helps protect insurance companies against digital crime and gives customers the reassurance they want from their insurer.

To read all of the data and more insights on how biometrics help prevent online crime in the insurance sector, download the report. We cover the following topics in full:

- Confirming proof of life

- Improving access to online portals

- Reducing the risk of account takeover

- Knowing your customer at onboarding

- Building trust online

If you’d like to learn more about the benefits of using biometric face authentication to secure and streamline your digital services, book your iProov demo here today.