October 20, 2022

Digital identity is a huge global opportunity for nations and citizens: according to research from McKinsey, countries extending full digital ID coverage to their citizens could unlock value equivalent to 3 to 13 percent of GDP by 2030. That’s no small figure.

But does the average person understand what digital identity means and how it can benefit them?

iProov surveyed 16,000 people across eight countries (Australia, Canada, Germany, Italy, Mexico, Spain, the UK, and the U.S.) to better understand how customers understand digital identity and how they feel about it. These statistics aim to aid organizations in optimizing their approach to digital identity – ultimately to better meet customer expectations. Read the full Digital Identity Report.

What Is Digital Identity?

Generally speaking, digital identity refers to the digitized information that exists about us online. Your digital identity is made up of lots of pieces of data; your name, your email address, your social security number, your driver’s license number – these could all be part of your digital identity.

The term digital identity can also be used to describe a ‘digital dossier’ that refers to one unique, physical human being. This could take the form of a digital ID wallet, for example.

A digital identity requires a completely unique identifier – such as an email address, a driver’s license number or a passport number – to bind digital information to a real, physical person. A name wouldn’t work, for example, because they’re rarely unique.

The way to ensure that only the real physical person can use their identifier as evidence of owning their digital identity is through authentication. If someone knows their email address or other identifier and can authenticate themselves successfully, then in theory only that person can access their digital identity. Traditionally, passwords have been used for authentication but they are no longer fit for purpose as they’re not secure and cause friction for the user. This is where biometric authentication comes in – it’s very secure and user-friendly. But more on that later.

Many of us use our digital identities every single day – simply by logging into a social network, we are using an email address and a password (or other digital identifiers and authentication methods), to confirm that we as a physical human are the rightful owner of that social media account.

For those people, the challenge is how to secure and simplify those identities. Each individual could easily have 100+ accounts online. If I want to use a new car rental firm, the question is whether I set up a new identity with them and give them my details, or if I use a digital wallet or other identity service so I only share the necessary data while also enabling the car rental firm to be sure that I am who I claim to be. The same applies to banks, retailers, hotels…anyone that needs to collect my information online.

But many people do not have a digital identity at all. This is a challenge for governments that need to be inclusive to all citizens. How do government agencies ensure that those citizens can establish a digital identity that is secure and gives them access to all of the services they need, from tax and benefits to banking and leisure services?

Ultimately, a digital identity that can be securely linked to a physical person is a fundamental right of individuals living in a digital world. There are many ways of managing and asserting a digital identity. But almost everyone needs one.

How Does Digital Identity Offer Opportunities for Growth?

1.7 billion-plus individuals are currently financially excluded, according to the World Bank. In both developed and less economically developed nations, the introduction of digital identity services can bring reassurance, convenience, and confidence to the majority of citizens – particularly those previously disenfranchised.

A digital identity would enable those individuals to engage, according to McKinsey, “as consumers, workers, microenterprises, taxpayers and beneficiaries, civically engaged individuals, and asset owners”, thus growing their local and national economies.

How Many People Know What Digital Identity Means?

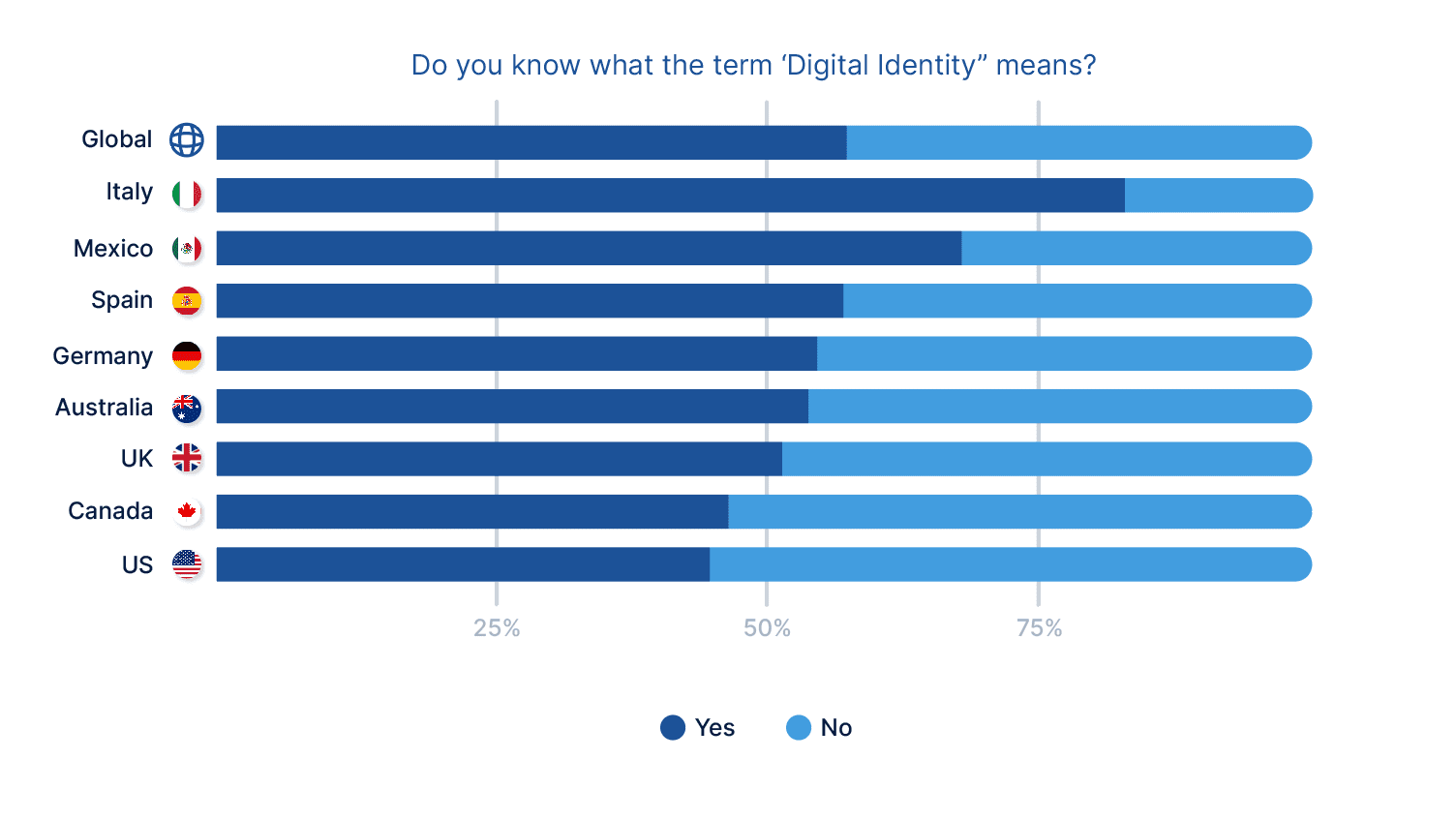

In 2022, iProov carried out a consumer survey of 16,000 consumers across eight countries. The goal was to assess consumer attitudes to online security and digital identities. You can read the full report here. What we found was very interesting:

- Globally, only 58% of the respondents said they knew what the term ‘digital identity’ meant.

- These results varied by country: for example, Italian respondents felt more confident that they understood the term, with 83% answering ‘Yes’.

- In comparison, the U.S. was the least confident in their understanding of digital identity, with only 45% of American respondents saying ‘Yes’ when asked if they knew what the term meant.

The implications of people not understanding digital identity are numerous and include:

- Fear and mistrust of digital identity services

- Delayed and overall lower take-up of digital identity services

- Fraud and identity theft caused by people using insecure methods to access services

Ultimately, this could mean that governments and enterprises struggle to make a success of their digital transformation programs, meaning individuals miss out on accessing online services. Digital identity is primed to be an area of huge global economic growth – but further expansion relies on public buy-in if uptake and usage are to be maximized.

How Do People Define Digital Identity?

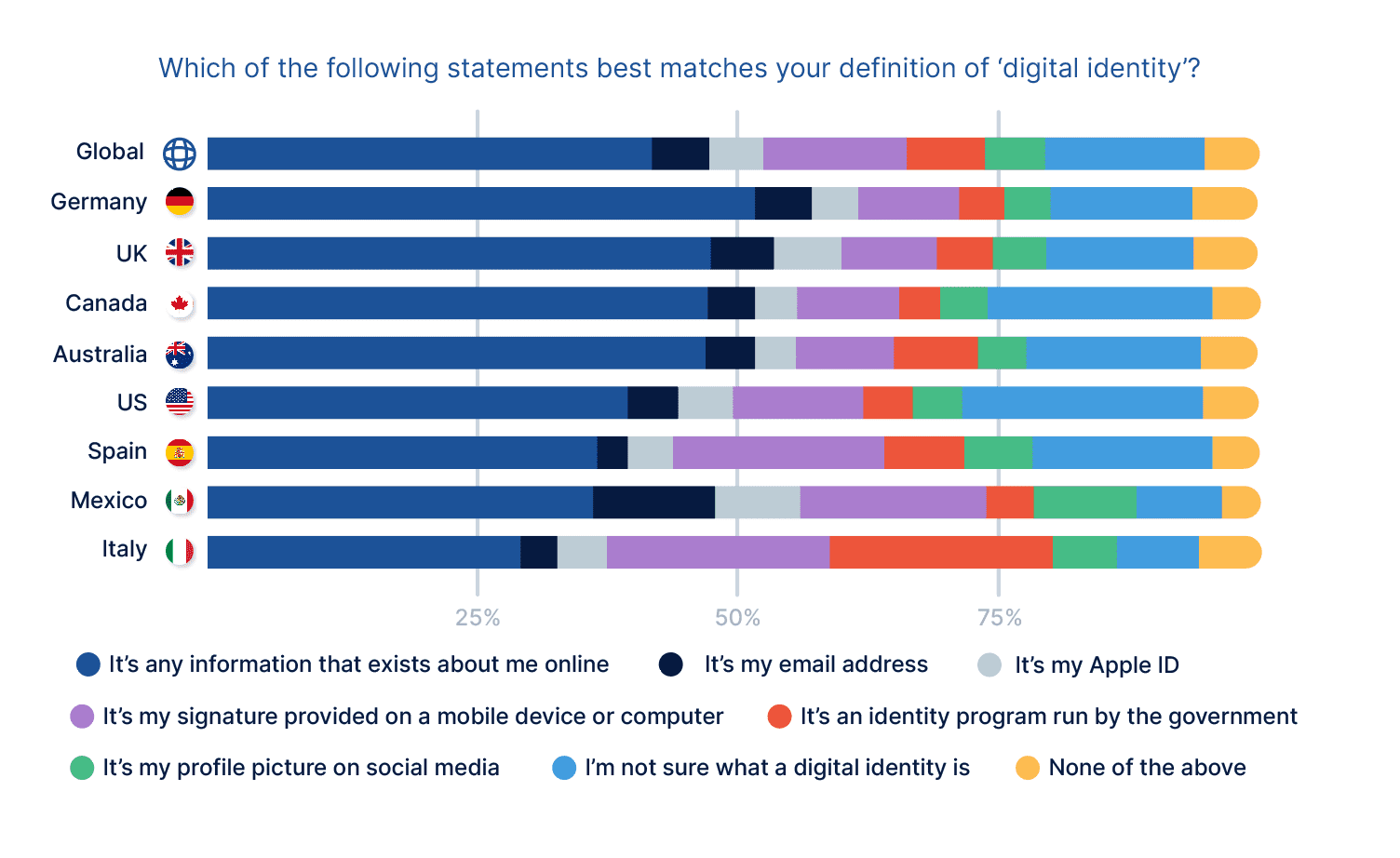

Although 58% of the respondents said they understood the term ‘digital identity’, we discovered a lot of confusion when we dug a little deeper into their understanding.

- 42% of respondents believed that digital identity is ‘any information that exists about me online’, which was the most accurate of the options given.

- German respondents were most likely to be right, with 52% saying digital identity is ‘any information that exists about me online’.

- 14% of respondents believed that their e-signature was their digital identity, while 5% thought it was their email address.

It was interesting to see that many Italian respondents saw digital identity as something provided by their government, perhaps indicating the success of their government’s national digital identity program. On the other hand, American and Canadian respondents were more likely to say that they do not know what a digital identity is.

As more governments roll out digital identity services, citizens and consumers should become more familiar with them, increasing trust and wider adoption.

Would People Use One Secure Digital Identity to Access Online Services?

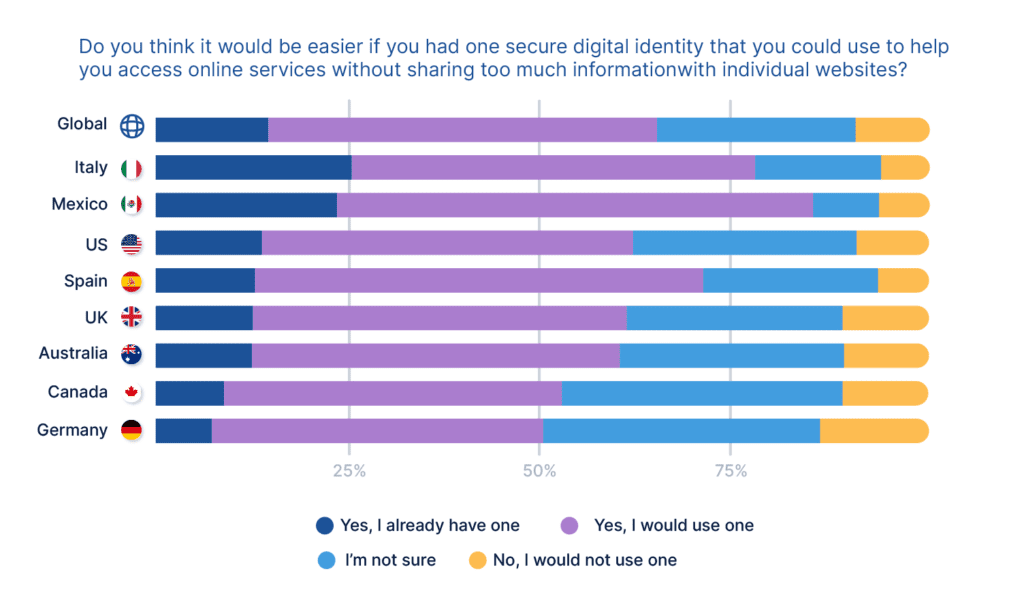

Although almost half of the respondents initially didn’t understand the term ‘digital identity’, our survey found that when the concept of a digital identity wallet or other single identity service was explained to them, there was great enthusiasm for it.

We asked the respondents whether they would be willing to use a single digital identity service, instead of having to provide their personal details to every individual website they wanted to use. The response was overwhelmingly positive.

- 90% of the consumers said they either already use or would consider using a single secure digital identity service.

- Italy and Mexico answered most favorably towards digital identity services: in Mexico, 85% of respondents either already use or would use a digital identity service. In Italy, it’s 78%.

Who Do People Trust to Handle Their Digital Identity?

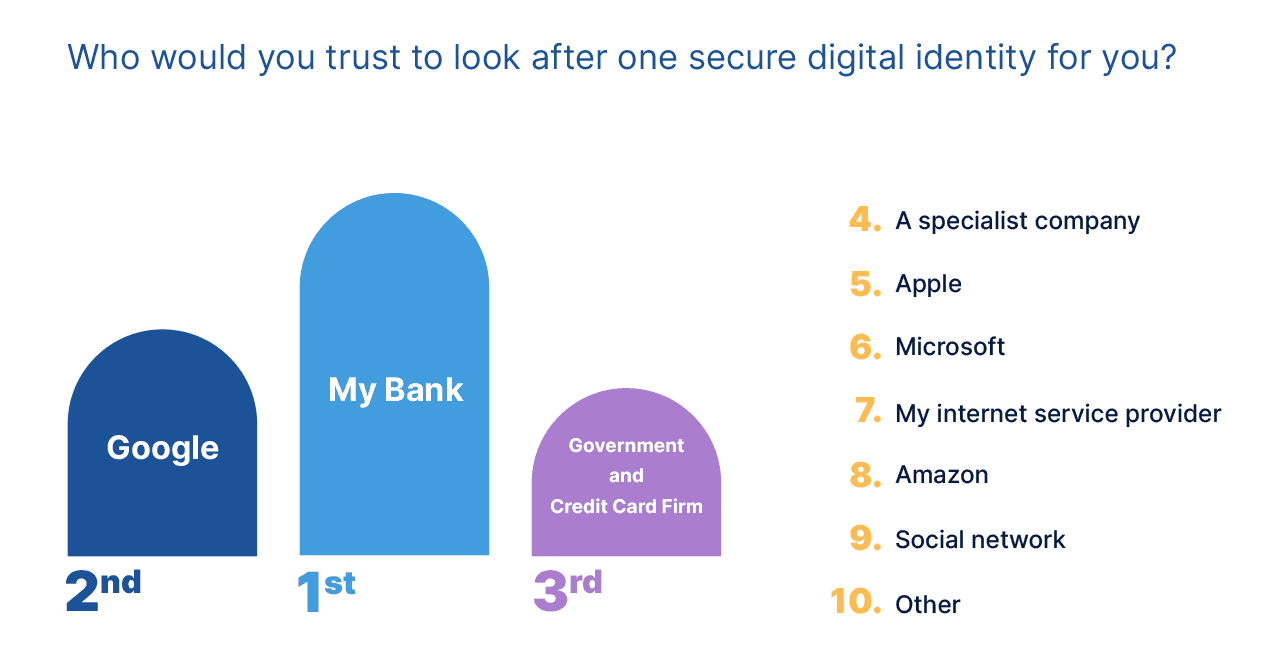

We then asked the respondents to choose which organization they would trust to provide their single, secure digital service.

- 49% said they would trust their bank to deliver their single digital identity service (it was the top choice in every country).

- 26% said they would trust Google (top in Mexico and lowest in Germany).

- 23% chose their government (highest in Australia and lowest in Mexico and the U.S.).

Banks are trusted by consumers because banks are proven to hold people’s valuable assets securely in an accessible way. People want the same for their data. They want to be sure that their data is held securely but that it is conveniently accessible to them when they need to use it.

Governments and non-financial enterprises need to think like a bank when it comes to managing data and identity to win trust.

Why Is Biometric Authentication Important for Digital Identity?

We’ve established that there is a huge demand for digital identity services, even though many consumers need more information and education on the subject. Governments and enterprises will need to consider this as they roll out digital identity services.

Aside from misunderstandings around digital identity, there’s a second issue. As Deloitte articulates:

“It’s not that the technology to shift to digital channels doesn’t exist. It’s that most governments lack the resources, capacity, and know-how to validate and protect their citizens’ digital identities.”

This is changing, however. Many governments around the world have understood the value of providing digital identity services and are using biometric authentication from iProov to deliver them securely.

Read more about the governments using iProov:

- US Department of Homeland Security

- Australian Taxation Office

- UK Home Office

- Estonia Smart-ID

- Singapore Government

This is because iProov’s unique, patented face verification technology enables governments to offer secure digital identity services by enrolling and authenticating individuals in an effortless way.

iProov Dynamic Liveness (GPA) uses an effortless face scan to confirm that an individual is the right person (not an imposter), a real person (not a mask or photograph being held in front of a camera), and that they are authenticating right now (not a digitally injected attack using deepfakes or other synthetic media).

GPA delivers best-in-class liveness detection, using patented Flashmark™ technology, to create a one-time biometric code that cannot be replicated. Read more about Dynamic Liveness here.

This highly secure, easy-to-use technology offers inclusivity to all, young or old, and can be used on any device with a user-facing camera including unsupervised kiosks.

Want to Know More About Government Digital Identity Services?

- Read our ‘Digital Identity Services: What Consumers Want and How Governments, Banks and Other Enterprises Can Deliver’ report

- Read more about Singapore’s SingPass national digital identity program

- Read about eIDAS and face verification for cross-border digital identity

- Visit our Biometrics for National Digital Identity web page here.

Digital Identity Statistics: A Summary

- Digital identity refers to the digitized information that exists about us online

- We use our digital identity to access online services by proving that we as a physical person are the owner of our digital identity

- However, iProov research discovered that 42% of people worldwide do not know what the term ‘digital identity’ means

- When the concept is explained to them, 90% of global consumers would use a single digital identity service

- Verification and authentication are crucial for managing our digital identity. Only iProov Dynamic Liveness can be trusted to deliver the right level of assurance required for enrolling individuals into digital identity solutions.

If you’d like to learn more about how iProov can secure and streamline your organization’s online verification, authentication, and onboarding for digital identity use cases, book your demo today.