in the Press

February 12, 2026

iProov Dynamic Liveness Is the First and Only Solution to Achieve CEN/TS 18099 High and Ingenium Level 4 for Injection Attack Detection

February 11, 2026

The New Terminal One at JFK Partners With CBP to Transform the International Arrivals Experience for U.S. Citizens

January 21, 2026

iProov President Joins U.S. House Homeland Security Roundtable on Biometric Innovation at Borders

December 19, 2025

Aruba Airport Authority N.V. Partners up with U.S. Customs and Border Protection and iProov to Introduce Enhanced Passenger Processing (EPP)

December 16, 2025

MITRE ATLAS™ Publishes Critical Vulnerability in the KYC Identity Process Discovered by iProov

December 9, 2025

iProov and HYPR Partner to Deliver the Ultimate Defense Against AI-Driven Workforce Identity Fraud

December 3, 2025

Thirdfort Combats £1.6 Billion UK Property Fraud Risk with iProov Identity Verification Technology

November 20, 2025

The Future of Identity, 2026 Predictions: The Commercial Imperative

November 3, 2025

iProov is First Biometrics Vendor to Demonstrate Deepfake Resilience, Under New NIST Digital Identity Requirements

October 15, 2025

UnionDigital Bank Implements iProov Liveness Solutions to Thwart Account Takeover and Mule Activity

September 17, 2025

iProov Threat Intelligence Uncovers New iOS Video Injection Tool Designed for Sophisticated Deepfake Attacks

September 10, 2025

Leading Fintech Group MoMo Partners with iProov to Safeguard Vietnamese Against Digital Fraud

September 8, 2025

iProov Launches On-The-Move Biometrics to Support U.S. Airports Enhanced Passenger Processing

July 2, 2025

iProov Appoints Alex Pearson as Chief Revenue Officer

June 12, 2025

iProov Wins SC Awards Europe 2025 Best Biometric Solution Award

June 4, 2025

iProov Threat Intelligence Uncovers “Grey Nickel” Threat Actor Targeting Banking, Crypto, and Payment Platforms

May 7, 2025

Orlando International Partners With CBP to Enhance Process for International Arrivals

March 24, 2025

iProov Launches Facial Biometric MFA Support Targeting Workforce Identity Theft

![20250311-[Project-ID]-HO-Maritime-Trials-Image-16×9-v1 Image of cars under tunnel of motorway - iProov / UK Government Maritime trials blog cover](https://www.iproov.com/wp-content/uploads/2025/03/20250311-Project-ID-HO-Maritime-Trials-Image-16x9-v1-scaled.jpg)

March 11, 2025

iProov Joins UK Home Office Research and Experience at UK Maritime Ports

February 27, 2025

iProov Issues Annual Identity Verification Threat Intelligence Report

February 12, 2025

iProov Study Reveals Deepfake Blindspot: Only 0.1% of People Can Accurately Detect AI-Generated Deepfakes

December 23, 2024

iProov Discovers Major Dark Web Identity Farming Operation

December 17, 2024

The Future of Identity: 2025 Predictions

December 9, 2024

iProov Integrates with Microsoft Entra ID for Seamless and Secure Workforce Access

November 5, 2024

iProov and Biometrid Partner to Deliver Secure and Seamless Digital Identity Verification in Portugal and Key International Regions

October 23, 2024

iProov and TrustCloud Partner to Transform Digital Identity Management with Post-Quantum Encryption

October 17, 2024

iProov Sees Over 60% Surge in Transactions Driven by Soaring Demand for Cloud-based Biometric Onboarding and Authentication

September 19, 2024

iProov and Guardline Partner to Fight Financial Fraud Crime in Latin America

August 14, 2024

Global Study Highlights Biometrics as the Solution of Choice to Counter Escalating Deepfake Risk

June 14, 2024

iProov Wins SC Awards Europe 2024 Authentication Category for Second Consecutive Year

June 6, 2024

iProov Becomes First Provider To Achieve FIDO Alliance Certification for Face Biometric Identity Verification

May 1, 2024

Four Out of Five Americans Believe Passwords Do Not Secure Access to Banking and Government Digital Services

April 8, 2024

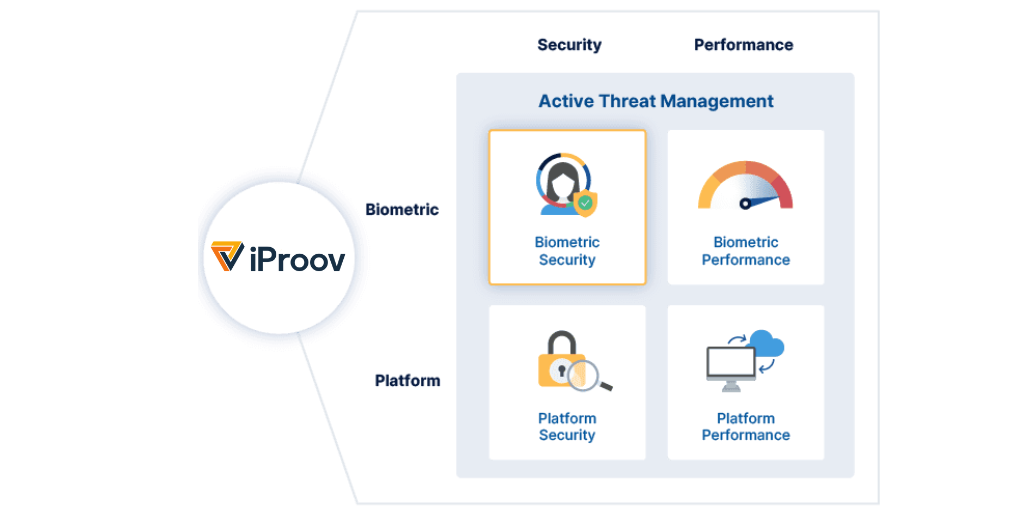

iProov Launches Biometric Solution Suite

April 8, 2024

iProov Appoints Chief Product Officer

March 25, 2024

Caf and iProov Join Forces to Combat Large-Scale Identity Fraud

March 13, 2024

iProov Appoints Leo Curran to Lead Global Partnerships and Alliances and Accelerate its Partner-Focused Strategy

February 21, 2024

iProov Reports Generative AI Threats Driving Momentum for Biometric Identity Solutions as Organizations Strengthen Digital Onboarding and Authentication

February 7, 2024

New Threat Intelligence Report Exposes the Impact of Generative AI on Remote Identity Verification

December 18, 2023

Unveiling the Future: 2024 Digital Identity Trends and Predictions

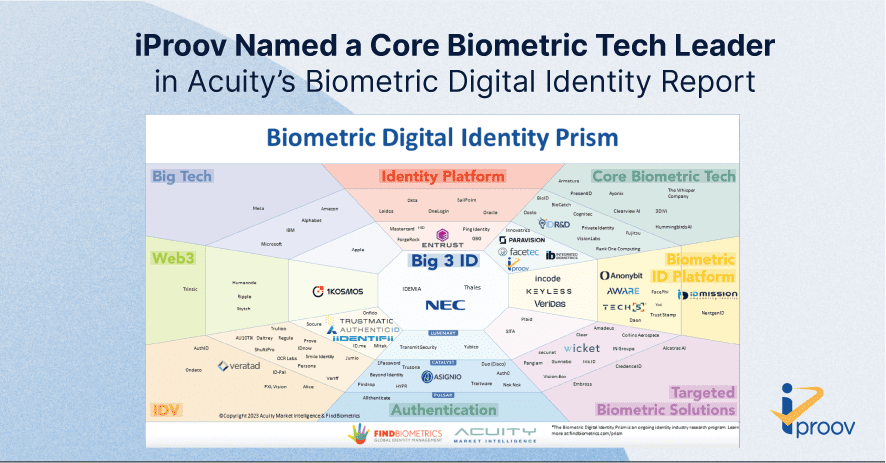

October 2, 2023

iProov Named A Core Biometric Tech Leader in Acuity’s Biometric Digital Identity Report

September 20, 2023

iProov Integrates with Ping Identity’s PingOne DaVinci to Enable Identity Verification for IAM/CIAM Using Proven Science-Based Facial Biometrics

September 13, 2023

iProov Partners with Cybernetica to Deliver Digital Signing and Authentication Solutions to Governments and Financial Services Organizations

July 18, 2023

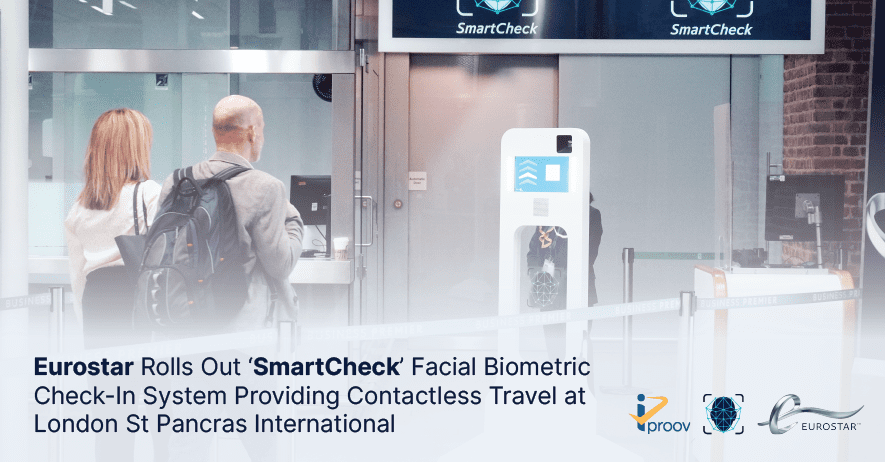

Eurostar Rolls Out ‘SmartCheck’ Facial Biometric Check-In System Providing Contactless Solution at London St Pancras International

June 27, 2023

iProov Scoops Top Spot in Authentication Category at SC Awards Europe 2023

June 13, 2023

iProov Embeds Facial Biometric Authentication Technology into Undercoverlab Tsubacheck Security Solution

May 10, 2023

Wultra and iProov Partner to Bring Biometric Technology to Banks and Financial Services Technology Providers

April 27, 2023

iProov Named Winner at the Coveted Global InfoSec Awards during RSA Conference 2023

April 25, 2023

iProov and Authsignal Partner to Offer Enhanced Online Fraud Prevention

April 20, 2023

DHS S&T Awards Funds to London Startup Developing Dynamic Liveness Technology for Remote Traveler Verification

April 20, 2023

How hackers outwit facial ID

April 13, 2023

Ajay Amlani, SVP Americas, iProov Interview with Identity Week

March 28, 2023

U.S. Department of Homeland Security Selects iProov For Secure Border Crossings

March 2, 2023

iProov Is Recognized in FT 1000: Europe’s Fastest Growing Companies

February 6, 2023

Biometric Threat Landscape Report Reveals Digital Injection Attacks Now Five Times More Common Than Presentation Attacks

December 15, 2022

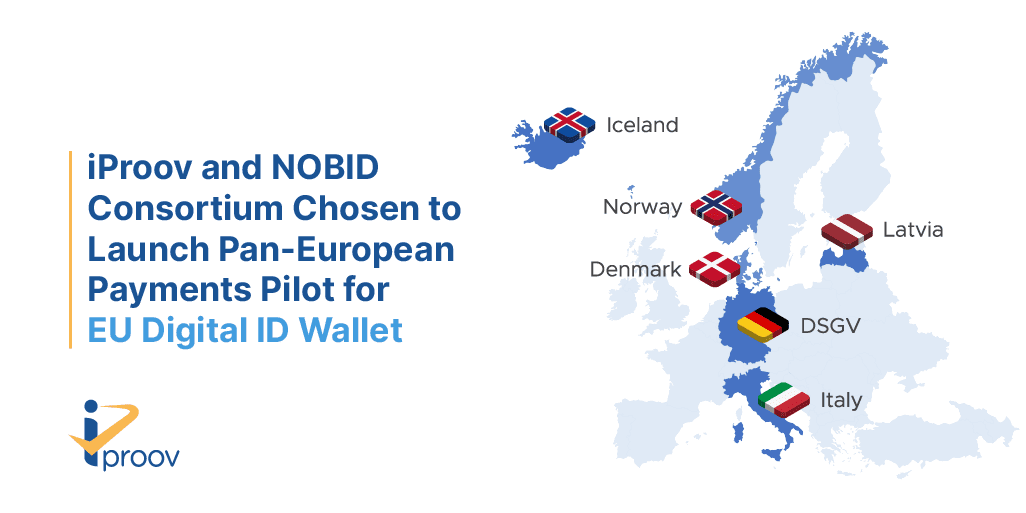

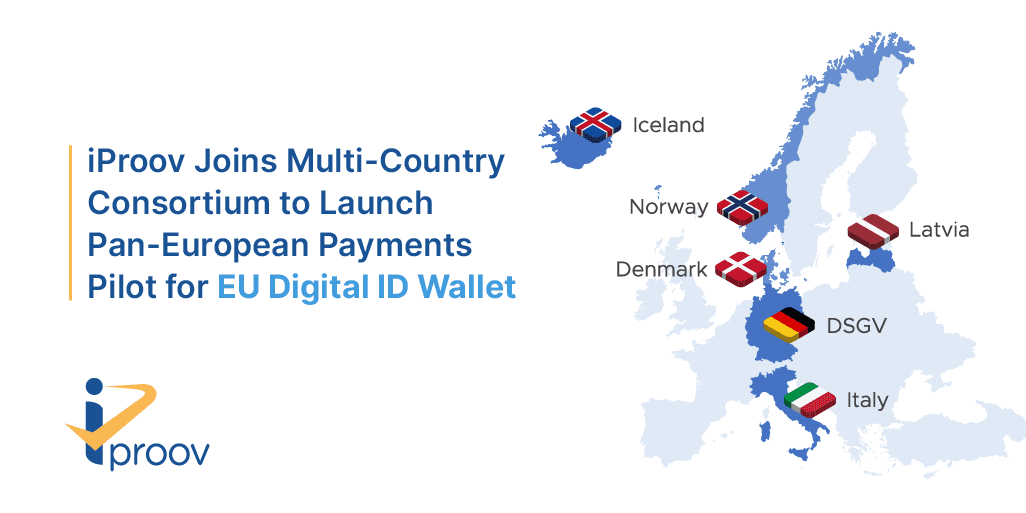

The NOBID Consortium Chosen to Launch Pan-European Payments Pilot for EU Digital ID Wallet

December 12, 2022

iProov Unveils Its Top 10 Predictions for Digital Identity and Biometrics in 2023

November 18, 2022

iProov Recognized in Deloitte’s Technology Fast 50 for Third Year Running

November 1, 2022

iProov Recognized as an Innovation Leader in Verified Identity by KuppingerCole

October 26, 2022

Wells Fargo and Zelle Network® Veteran Lou Anne Alexander Joins iProov Corporate Board

October 24, 2022

iProov and Microblink Partner to Offer a Comprehensive Identity Verification Solution

October 17, 2022

72% of Consumers Worldwide Prefer Face Verification for Secure Online Services

October 4, 2022

iProov Affirms Industry-Leading Security and Privacy of its Biometric Authentication with SOC 2 Certification

September 26, 2022

iProov Appoints Nicole Rowe as Chief Marketing Officer

September 14, 2022

iProov Joins Multi-Country Consortium to Launch Pan-European Payments Pilot for EU Digital ID Wallet

August 24, 2022

iProov Names Ajay Amlani as SVP, Head of Americas

August 11, 2022

iProov Achieves eIDAS eID Level of Assurance High for Dynamic Liveness

July 6, 2022

Paxful Selects iProov to Provide Effortless Security for Cryptocurrency Onboarding and Transactions

June 15, 2022

iProov Further Expands Online Identity Verification Services in the Americas with Ignition-Innovation’s New Civic ID Solution

June 9, 2022

Nuggets and iProov Partner To Bring Biometrically Verified Self-Sovereign Identity and Payments to Web 2 and Web3

June 7, 2022

What Does the Future of Travel Look Like? A Majority of Consumers Favor a Journey Straight from the Couch to the Gate

June 1, 2022

iProov Is Recognized as One of the World’s Most Innovative Companies in the CyberTech100

May 31, 2022

Finema Partners with iProov to Bring Enhanced Liveness Detection Capabilities to Identity Solution Onboarding

May 17, 2022

iProov’s Dynamic Liveness Technology Wins Gold at the 2022 U.S. Govies

April 5, 2022

iProov Expands Team with New Chief Information Officer

March 23, 2022

iProov Achieves eIDAS Service Module Certification to Qualified Trust Level

March 15, 2022

iProov Launches New Global Partner Program to Meet Worldwide Demand for Online Identity Verification

March 1, 2022

iProov Recognized in FT 1000 as One of the Fastest Growing Companies in Europe

February 24, 2022

iProov Wins Best Biometric Solution at the Cyber Security Global Excellence Awards 2022

February 3, 2022

iProov patents document verification tech

February 2, 2022

iProov Granted U.S. Patent to Expand Genuine Presence to Verify Driver’s License and Government ID Imagery and Surface

January 26, 2022

iProov Working with Women in Identity to Support Diversity and Inclusion

January 6, 2022

iProov snaps up $70M for its facial verification technology

January 6, 2022

Biometric authentication company iProov raises $70M

January 6, 2022

iProov Announces $70M Investment from Sumeru Equity Partners

December 16, 2021

iProov Reports Record Year as Demand for Secure Online Identity Verification Soars

December 6, 2021

Eurostar using face scans in fast-track ticket and passport trial for passengers leaving UK

December 6, 2021

iProov and Eurostar Launch Trial to Provide Contactless Travel at London St Pancras International

November 19, 2021

iProov Named in Deloitte Fast 50 of UK’s Fastest Growing Technology Firms

October 25, 2021

iProov, MATTR, and the University of Washington to Create Solution to Thwart the Spread of Disinformation Online for the National Science Foundation

October 7, 2021

Andrew Bud CBE, iProov Founder and CEO, named among 50 Most Ambitious Business Leaders

September 15, 2021

Facial tech is catching on with banks

August 6, 2021

Brace Your Customers for Deepfakes

July 29, 2021

iProov Achieves Record-Breaking Growth as Demand for Dynamic Liveness™ Soars

July 20, 2021

Synaps Chooses iProov’s Dynamic Liveness for Secure Onboarding and KYC in Cryptocurrency

May 17, 2021

iProov Named Winner of Coveted Global InfoSec Award During RSA Conference 2021

April 28, 2021

Canadian Banks Fail to Offer Online Convenience to Customers

April 20, 2021

iProov face verification selected by itsme® to support global expansion

April 15, 2021

90% of Americans Would Pay Extra to Renew Driver’s License Online

April 13, 2021

Cyber Security Veteran Joins iProov Advisory Board

April 8, 2021

Jumio Adds iProov’s Award-Winning Liveness Detection to its KYX Platform

March 16, 2021

Australian Taxation Office extends national digital identity program with face verification technology from iProov

March 10, 2021

Vaccine certificate technology is ready if ethical issues can be addressed, says iProov CEO

February 16, 2021

BBC Radio 4 talks with Andrew Bud, CEO of iProov, about vaccine certificates

February 3, 2021

iProov Research: U.S. Banks Missing Out on Online Growth Opportunities

December 10, 2020

iProov announces record growth in 2020

November 20, 2020

iProov Recognized in Deloitte’s 2020 UK Technology Fast 50 list

November 13, 2020

Biometric Experts iProov Support UK Home Office With Identity Verification

November 10, 2020

iProov partners with TRUSTDOCK, bringing Dynamic Liveness to e-KYC

November 9, 2020

Department of Homeland Security Awards iProov $198K to Pilot Genuine Presence Detection

November 6, 2020

5 Things You Need To Know To Optimize Your Company’s Approach to Data Privacy and Cybersecurity

October 28, 2020

New Report: U.S. Banks Prioritize Security at the Expense of the Customer Experience

October 22, 2020

iProov recognized as a Gartner Cool Vendor

October 12, 2020

In Singapore, facial recognition is getting woven into everyday life

October 6, 2020

iProov Introduces Flexible Biometric Customer Authentication for Global Enterprises

September 25, 2020

Singapore in world first for facial verification

September 22, 2020

UK firm to power face verification in Singapore’s digital identity system

September 22, 2020

Singapore Government Extends National Digital Identity programme with iProov

September 3, 2020

iProov launches world’s first global threat intelligence system for biometric assurance

August 12, 2020

iProov Partners With Evernym to Simplify Onboarding and Device Binding for Personal Identity Management

August 5, 2020

Acuant Integrates iProov Patented Biometric Authentication Into Its Trusted Identity Platform

August 3, 2020

Mvine first with antibody test status prototype

July 13, 2020

iProov Partners with IDV Pacific to Enhance Online Identity Verification in Australia and New Zealand

July 7, 2020

iProov Provides Online Biometric Safeguarding for Intergenerational Mentoring Platform, bloomd

July 1, 2020

iProov to Provide Biometric Technology to Challenger Bank Knab, Part of AEGON

June 23, 2020

Mvine and iProov formalise a new agreement to partner

June 18, 2020

Eurostar to introduce face scan technology for passport-free travel to Europe

June 17, 2020

iProov to Provide Contactless Travel Entry for Eurostar as Part of Railway Innovation Initiative

June 11, 2020

iProov partners with RegTech specialist NorthRow to improve customer due diligence in the property, professional services and FinTech sectors

May 29, 2020

iProov supports bkynd in fight against coronavirus with biometrics for safeguarding

May 20, 2020

iProov Providing Facial Authentication for NHS Login (Android & iOS)

April 15, 2020

iProov Brings Biometric Authentication to the Web Browser

February 28, 2020

iProov to Provide Biometric Technology for Estonia’s Digital Identity Program

February 13, 2020

iProov’s Cross-platform Biometric Technology Now Available Beyond Mobile

February 12, 2020

iProov Expands Its Presence in U.S. Biometric Security Market

December 27, 2019

Technology pioneer, Andrew Bud, honoured with CBE for services to export

October 1, 2019

Almost Three-Quarters of UK Public Unaware of Deepfake Threat, New Research Reveals

February 11, 2019

iProov launches brand new cross-platform biometric: Palm Verifier

February 7, 2019

iProov’s World-Leading Dynamic Liveness Deemed State of the Art by NPL

April 16, 2018

iProov wins US Department of Homeland Security contract