June 2, 2020

Rabobank is one of the 50 largest banks in the world, with over 40,000 employees. As part of their ongoing commitment to customer service and innovation, in 2018 the onboarding team at Rabobank decided to find a solution to a challenge: how to successfully onboard 18-year-old customers that needed an adult account.

According to Evelien Mooij at Rabobank, the team had realised that the usual process for setting up a bank account – a customer bringing documentation into a branch – was not very appealing to digital natives that prefer to look at their phones.

So Rabobank began a project with their innovation department, looking for a digital onboarding solution that would bring the process onto a customer’s mobile phone. This led them to InnoValor, who worked with Rabobank and iProov to create an innovative technology solution that included:

- The creation of an app for onboarding.

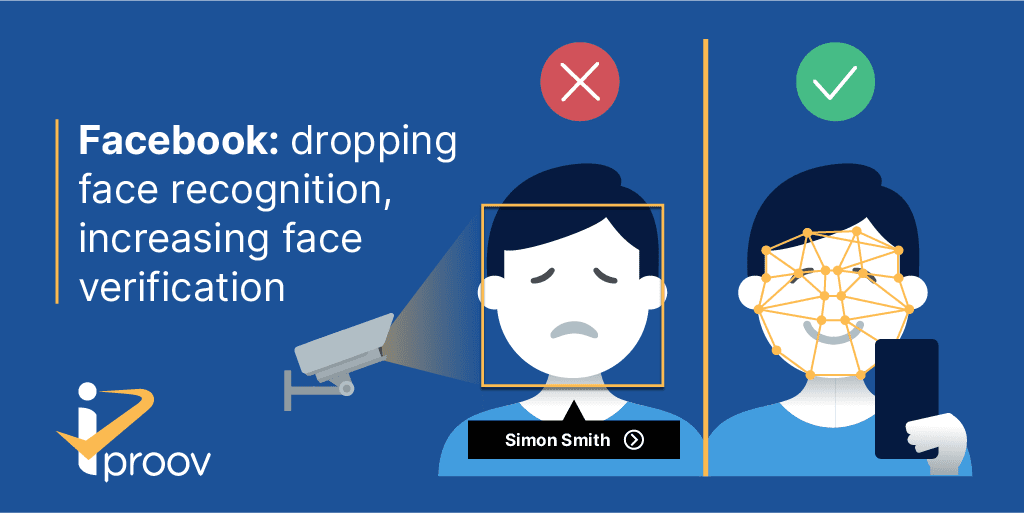

- Remote identity documentation checking using the InnoValor solution. Passports, driver’s licenses, or other ID credentials can be scanned using a phone using either near field communication (NFC) to read the chip in the document, or optical character recognition (OCR) which reads information from a photo of the document.

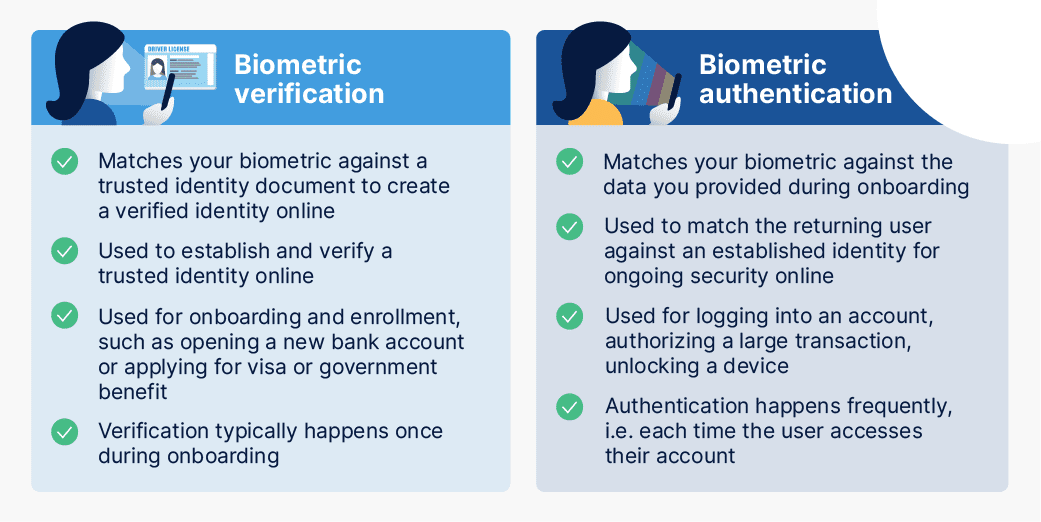

- Biometric identity authentication using iProov’s Dynamic Liveness technology to ensure that the person is the right person, a real person, and authenticating right now.

For Rabobank, this was a very exciting initiative. The compliance component was huge, but the targeted scope of the project allowed them to initially focus on a small group of customers. By working specifically with a target segment of 18-year-olds, the team could gain a lot of experience on how to create an online onboarding journey before scaling out to others.

It worked. 300 customers are now using the mobile onboarding process every day. Channel share has gone from 35% last year to 60%.

The team met some challenges along the way. Initially, the solution included NFC only on Android devices, with OCR for everyone else. 50% of customers were dropping out of the journey as the photo imaging quality wasn’t always good enough – too much glare on the photos or other issues.

Apple’s decision to support NFC from September 2019 changed everything. 80% of customers now use NFC, although Rabobank still uses OCR as a back-up for users – if your chip is broken, you need OCR for an online journey and that’s still provided.

Another challenge was getting the compliance team on board. Like most banks, Rabobank is a very big organization with a lot of legacy systems and a complex architecture. Eight Rabobank teams and three suppliers were involved in the project, which meant complexity. Evelien and her team involved their colleagues early on, so that everyone could see the decisions and choices that were being made.

And in fact, NFC has helped with compliance; the quality of identity verification is better on the app than it is face-to-face. It might be possible to trick an employee, but it’s much more difficult with iProov’s best-in-class biometric technology.

Evelien and her team had also been concerned about the use of a standalone app for onboarding. Would customers use it? Would it be an issue? A lot of research was done, with initial customer feedback suggesting that it wasn’t going to be a problem. The results since launch have supported this – to the surprise of the team, customers are really not worried about the separate app.

The next steps for Rabobank include: using the app for onboarding new business users who don’t already have an account and processing change of director notifications; adding remote identification to the main Rabobank app; and bringing in step-up authentication for complex or high-value transactions.

How does iProov make your onboarding effortless? Find out more here.