October 2, 2025

Cryptocurrencies have seen explosive growth and mainstream adoption in recent years, with the total crypto market capitalization peaking at over USD 4 trillion, reaching that mark in July 2025. As this digital asset class gains increasing adoption, there is a heightened need for proper regulation and compliance measures to be implemented.

Some investors store crypto in “cold wallets,” but to buy, sell, or trade, most create accounts with exchanges like Binance and Crypto.com. Unlike cold wallets—where lost passwords can mean losing millions forever — exchanges can usually restore access by verifying a user’s identity.

But with this financial responsibility comes increasing regulation and legal scrutiny, such as Know Your Customer (KYC) and Anti-money Laundering (AML) checks. In some jurisdictions, exchanges are covered by AML regulations, such as AML6 in Europe, while in others, the laws surrounding digital assets are still being solidified.

Cryptocurrency exchanges operate at the intersection of innovation and risk. The stakes have never been higher: in 2024 alone, hackers stole $2.17 billion in crypto, and by mid-2025, theft levels are already rivaling last year’s total. Meanwhile, regulators worldwide have made their position clear — strong identity verification is no longer optional for exchanges that want to survive and grow.

This isn’t just about avoiding fines. It’s about trust, competitive advantage, and long-term viability. Exchanges that cannot assure users and partners of secure, compliant onboarding will struggle in today’s market. That’s where biometric verification comes in.

Many cryptocurrency exchanges with weak KYC and AML processes risk severe compliance penalties. iProov technology helps by verifying user identity during onboarding and authentication in a way that’s secure, inclusive, and effortless—the foundation of proper KYC and AML compliance efforts.

Why Identity Verification Matters More For Crypto Exchanges in 2025

The regulatory and market environment has changed dramatically in recent years. Today:

- 92% of centralized exchanges are fully KYC compliant

- Onboarding is faster than ever: average KYC time is now ~3.5 minutes

- KYC reduces crypto fraud risk by ~38%

- Users increasingly prefer regulated platforms: 58% of U.S. crypto users say they favor exchanges with strong KYC, signaling a market preference for regulated platforms (Coinlaw).

Identity verification has evolved from a compliance checkbox into a competitive differentiator. A seamless, secure onboarding experience attracts customers, while poor security and friction drive them away. For crypto exchanges facing margin pressures, every abandoned onboarding represents lost revenue — making verification speed and accuracy business-critical.

Why Biometrics Beat Traditional Verification

Traditional verification methods — static ID uploads and manual document reviews — are slow, add friction, and are vulnerable to fraud. Biometric verification offers a faster, more secure alternative that addresses core challenges:

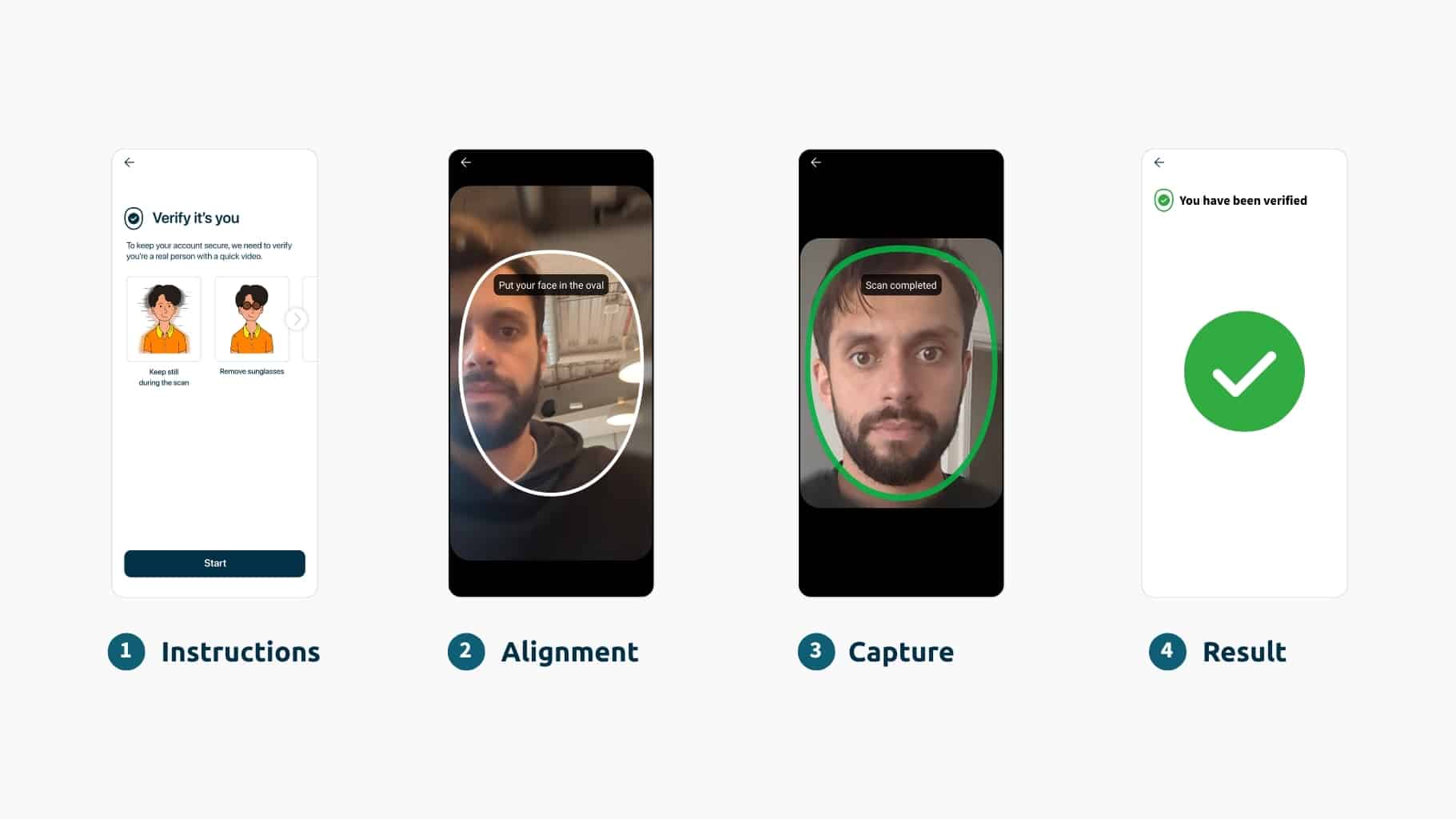

Speed and User Experience: What once took days can now be completed in minutes. With over 60% of users comfortable using selfie biometrics for online verification, the technology has achieved mainstream acceptance. This speed directly impacts conversion rates: more customers onboarded means more revenue.

Security and Fraud Prevention: Biometric verification confirms a user’s identity through live facial scans, making it exponentially harder to fake than static documents. This is particularly vital during high-value transactions, crypto transfers to external wallets, and changes to personal details—all moments when exchanges need the highest assurance.

Regulatory Compliance: Regulators now expect identity proofing methods that can withstand spoofing and synthetic attacks. Biometric systems provide auditable logs and high-assurance checks that traditional document scans cannot match. For exchanges seeking banking partnerships, cross-border market access, or operating under MiCA in Europe, robust biometric verification is increasingly non-negotiable.

Ongoing Authentication: Beyond onboarding, biometrics enable secure, passwordless authentication for returning users. Unlike OTPs—which can be intercepted or phished—biometric authentication verifies the actual person attempting to access the account, providing security for step-up authentication, multi-factor authentication, and account recovery scenarios.

The Deepfake Threat: Why Not All Biometrics Are Equal

One of the most significant developments is the explosion of AI-powered fraud. Attackers now deploy deepfakes and synthetic identities to trick exchanges and take over accounts.

This means biometric systems must evolve beyond simple face matching. Solutions need advanced liveness detection that can distinguish a real person from an AI-generated spoof. Without it, exchanges risk onboarding synthetic users who bypass KYC and move funds undetected.

As injection attacks and replay attacks grow more sophisticated, cloud-based verification—untethered from potentially compromised device sensors—adds a critical security layer that can’t be reverse-engineered by attackers.

The threat landscape is evolving rapidly, and exchanges must ensure their biometric solutions can defend against both current and emerging threats through active threat management and continuous updates.

Real Use Cases for Crypto Exchanges

Leading exchanges are deploying biometric verification across three critical touchpoints:

Remote Customer Onboarding: New users verify their identity by matching their live face to a government-issued photo ID, creating a biometric profile that links their real-world identity to their digital account. This process must be seamless—any friction increases abandonment rates.

Customer Authentication: When users return to trade, withdraw funds, or modify account details, biometric authentication confirms they’re the legitimate account holder. This eliminates the security vulnerabilities of password-based systems while delivering a frictionless experience.

Account Recovery and Rebinding: If a user loses their device or switches to a new one, cloud-based biometric verification enables secure account access without forcing them to re-enroll. This reduces support burden while maintaining security integrity.

Dynamic Liveness for Cryptocurrency Exchanges

Dynamic Liveness uses a simple, passive face scan to ensure that an individual is:

- The right person, using face matching + matching the identity to a trusted photo identity document.

- A real person and not a presentation attack (a physical or digital artifact presented to the device sensor, like a photo or mask).

- Authenticating right now, and not a digitally injected attack using a deepfake or other synthetic media (ensured by a one-time biometric delivered by Flashmark).

Dynamic Liveness assures users are authenticating in real-time and comes with iSOC active threat management in addition to liveness detection, so is the recommended technology for verifying the identity of users in higher-risk scenarios.

The Path Forward

In 2025, cryptocurrency exchanges face a fundamental truth: weak identity verification is no longer viable. Fraud, AI attacks, and tightening regulations have made robust biometric verification essential.

The winners will treat biometrics as a cornerstone of customer trust and growth, not just compliance.

Looking ahead, decentralized identity models and continuous authentication will likely give users more control, while helping exchanges reduce reliance on single, one-time checks.

The question is no longer whether to implement biometric verification, but which solution delivers the right mix of speed, security, and user experience.

Learn more about how iProov helps cryptocurrency exchanges deliver secure, compliant onboarding with advanced liveness detection. Request a demo or explore our complete guide to KYC and AML compliance.